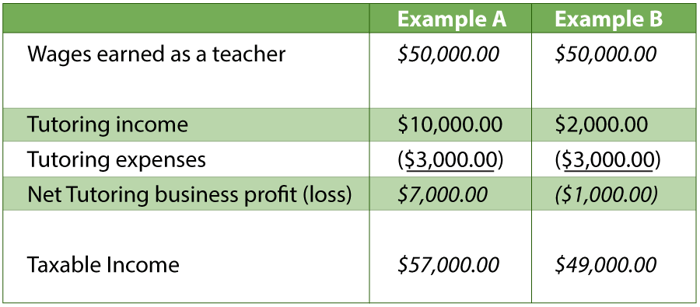

tax benefit rule examples

Joe and Denise Smith itemize deductions on their 2018 income tax return. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

Personal use is any use of the vehicle other than use in your trade or business.

. Its also the name of an IRS rule requiring companies to pay taxes on income that was previously written off but is subsequently recovered. If a taxpayer for example claimed as a business expense bad debts are written off amounting to 3000 in 2019 and in 2020 managed to recover 2000 of the amount written off the 2000 must be. Another example would be if somebody had to pay for repairs after an accident but later recovered the money in court from the person held responsible.

Consider a taxpayer who pays 10000 of state income taxes in year 1 and 10000 in year 2 both payments for year 1 taxes. Wander away from your charitable purposes into the land of too much private benefit and especially the quicksand of inurement of your. For 2022 the standard mileage rate is 585 cents per mile.

Jones recovers a 1000 loss that he had written off in his previous years tax return. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. If the amount of the loss was not taken as a deduction in the year the.

Then your 401 k investments can grow tax-free and you dont have to pay taxes until you. If youre looking for a way to lose your hard-earned section 501 c 3 tax exemption we explained in an earlier post heres how. Examples of tax benefit.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return. The rule can also. 115-97 TCJA Congress enacted new Internal Revenue Code Section 164 b 6 limiting individuals state and local tax SALT.

In December 2017 as part of the Tax Cuts and Jobs Act PL. Todays announcement does not affect state. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction.

On Schedule A they listed real estate taxes of 7000 and state income taxes of 7000. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. Learn it well before April 15 arrives.

One example of a situation covered by the tax benefit rule would be if a business listed an unpaid debt as an expense lowering its taxable income then recovered the money in a future tax year. For example a state tax refund you must report as income the amount of tax benefit you had received from the amount of the. Small Business Tax Guide.

The year 1 deduction for state income taxes is the 10000 paid in year 1. According to the tax benefit rule - part of the state income tax refund above standard deduction is included into 2012 taxable income. A somewhat more complicated and more common example involves payments of state income taxes in both year 1 and year 2.

Tax benefit rule examples - LetspracticeExample2Taxbenefitrule. The way to look at the rule is what would your tax return have looked like if you had NOT claimed the deduction. Copyright 2008 HR Block.

A taxpayer used a standard deduction in 2011. The 1000 must be included in his current years reported gross income. You can use the cents-per-mile rule if either of the following requirements is met.

So for example if Jane bought a 500 ticket to a nonprofit fundraising gala and received a dinner worth 100 she could only claim 400 as a tax deduction. The most common example is a state income tax refund of tax deducted in the prior year. However in 2012 the taxpayer receives a state tax refund.

The rule is promulgated by the Internal Revenue Service. Legal Definition of tax benefit rule. For example lets assume that in 2009 Company XYZ expected to receive 100000 from a.

The Private Benefit Rule. How Does a Tax Benefit Work. If you didnt derive a benefit from claiming the deduction the refund isnt taxable.

What is the Tax Benefit Rule. This rule in theory might help curb. For example with a traditional 401 k the tax benefit is that you can reduce your taxable income based on the contributions to your retirement account.

You receive an Iowa tax refund of 1000 when you filed your 2016 tax return in 2017. This amount must be included in the employees wages or reimbursed by the employee. Example of the Tax Benefit Rule.

The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

Ask A Nurse What Tax Benefits Can I Claim As A Registered Nurse Nursejournal

What Is A Homestead Exemption And How Does It Work Lendingtree

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Annuity Taxation How Various Annuities Are Taxed

What Is The Standard Deduction Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Pre Tax Vs After Tax Medical Premiums

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Annuity Taxation How Various Annuities Are Taxed

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

What Is The Standard Deduction Tax Policy Center

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

/TaxBenefit-45ba63a4dbdc40f791f03795102d611f.jpg)